The Elevator Pitch

If there is only 1 takeaway in the next 15 minutes, then take this away – Pop Mart is a criminally overrated stock like a bubble that is ready to pop. I initiate a 6-months tactical short on Pop Mart with a target price of HK$14.30 (20x NTM P/E), -38% upside from 10-Feb-22’s closing price of HK$22.90.

Current valuation and street expectations has become disconnected from reality. Hear me out… Pop Mart’s product popularity is on the decline, backed by eroding resale value in secondary market. Management has acknowledged that their pop toy business in China has peaked, and the medium-term growth strategy is to expand overseas. The firm continues to struggle with operational challenges evident from the past 2 years of contraction on margins. Domestic competitive landscape is also set to intensify as players such as KK Group and 52TOYs eyes for listing. Despite the confluence of challenges stacked against Pop Mart, street continues to overlook the inevitable slowdown and bakes in high double-digit growth on earnings. For context, Pop Mart opens on average 80-100 new retail stores per year. Reverse DCF from current stock price implies Pop Mart is opening > 400 new retail stores per year for the next 3 years. Clearly, street is setting too high an expectation on growth.

I assign 20x NTM P/E on base case with +24% topline growth, 19% operating margins, and +22% EPS growth. This translates into a target price of HK$14.30, -38% upside from 10-Feb-23’s closing price of $HK22.90. Should my risks play out, Pop Mart could see a bull case of +11% upside and an overall risk to-reward of 1 to 3.3 - what are you waiting for? SHORT!

My Thesis

Pop Mart’s current valuation and street expectations today has become disconnected from reality. Here’s why…

Firstly, Pop Mart’s product popularity is on the decline, backed by eroding resale value in secondary market. Secondly, management’s tone on the company’s outlook suggests their pop toy business in China has peaked, and the medium-term strategy to drive growth is to expand overseas. Thirdly, Pop Mart has been struggling with operational challenges evident from the past 2 years of material contraction on their gross and operating margins. I allude this back to the fundamentally uncompelling competitive advantage that Pop Mart possesses. Finally, the competitive landscape of pop toy retail in China is also set to intensify as domestic players such as 52TOYS and KK Group eyes for listing and expand aggressively.

Despite all these, the market isn't pricing in any inevitable slowdown in Pop Mart’s top and bottomline growth. Consensus view continues to bake in high double-digit growth on earnings while downplaying the confluence of challenges that Pop Mart is struggling with (and will continue to do so).

Gone are the days of easy share gains and low base effect… According to an interview with Pop Mart CEO, opening a store abroad is 30-50% more expensive and requires 6-8 months to open (vs. 3 months for domestic stores). This alone already hinders Pop Mart’s store opening run rate, what more from the impact of higher OpEx on margins. On the other hand, Pop Mart’s inventory has been building up on an accelerated level with no signs of slowing down while top and bottomline growth continues to decelerate faster-than-expected. The firm’s online sales channels of Tmall and JD is simply an avenue for destocking unpopular SKUs. Despite the destocking strategy, Pop Mart’s topline continues to struggle in 2H22 with FY3Q22 reflecting -20% to -40% yoy decline in sales from Tmall and JD online stores. Channel checks from 魔镜数据, for the period of Sep-22 to Dec-22 indicated Tmall sales were down yoy by -54%/-34%/-55%/-18% respectively. I reckon similar results for its JD online sales. Offline sales aren’t any better with retail stores and Roboshops sales down yoy by -5% and -30% respectively.

Why now?

Reverse DCF from current share price (HK$22.90 as of 10-Feb-2023) suggests street is expecting a 3-year CAGR of 62% and 76% on topline and operating profits respectively from FY23E to FY25E. Meaning to say, Pop Mart will need to open > 400 new stores per year (33 stores per month) with ~500bps of margin expansion for the next 3 years. Clearly, street is setting too high an expectation on how fast Pop Mart can expand abroad in driving growth and has overlooked Pop Mart’s product popularity struggles, operational challenges, and an intensifying competitive landscape.

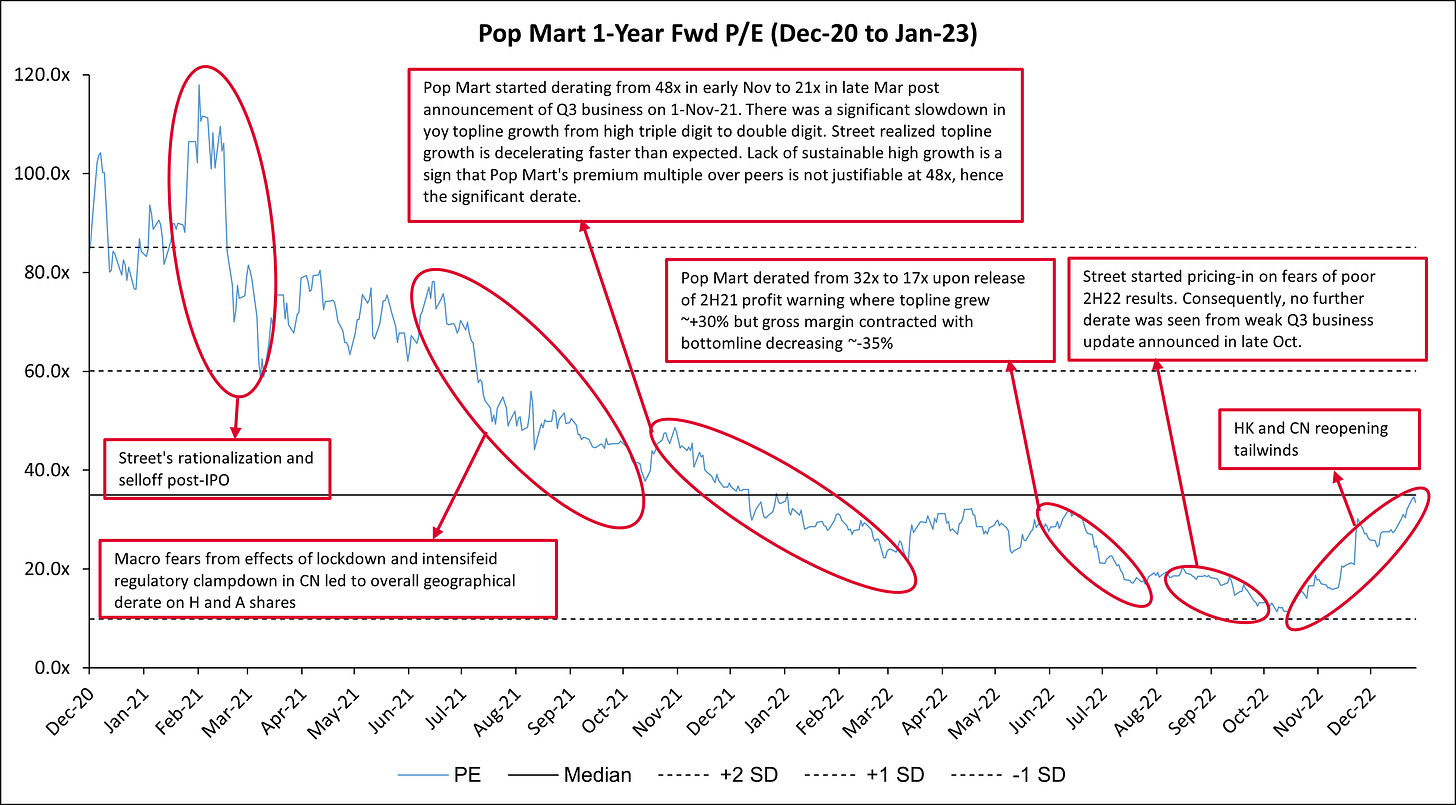

It is worth mentioning that consensus has always overestimated Pop Mart’s actual earnings since its listing. I think a more realistic expectation would be 70-120 new stores and 300-500 new Roboshops per year for FY23-25E with 250-300bps of erosion on margins due to increased shipping costs and sales & distribution costs from Pop Mart’s overseas expansion. From late Aug-22 to early Nov-22, Pop Mart’s P/E derated from 21x to 11x. It is likely street has priced in a weak set of results for 2H22E. From Dec-22 to Jan-23, Pop Mart’s P/E rerated from 15x to 28x purely due to tailwinds of China’s reopening with no changes on fundamentals.

Historical valuation movement depicts street’s poor habit of overestimating the kind of top and bottomline growth profile Pop Mart can achieve. Till date, there are no fundamental changes on Pop Mart which drove a rerate to its P/E multiple. I believe street has once again overestimated the magnitude of Pop Mart’s overseas expansion strategy and the negligible, if any, effects of China reopening tailwind on Pop Mart’s fundamentals.

How to think about valuation today

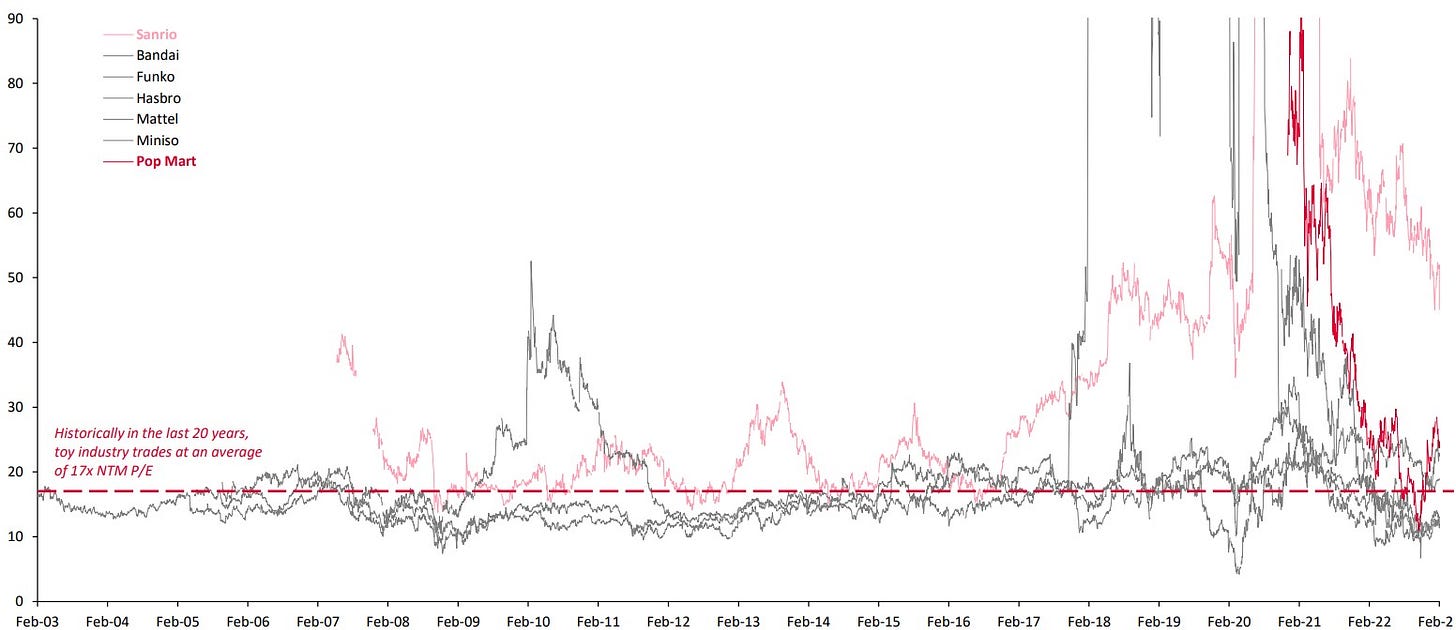

The street values Pop Mart and global toy manufacturers on price-to-earnings (P/E). The toy retail industry has been trading at an average of 17x P/E in the last 24 years – refer to appendix for full illustration). Ability to achieve operating margins north of 15% or superior earnings growth relative to peers tend to drive 4-6x of P/E rerate. Apart from Sanrio, no other players have been able to trade sustainably above 25x P/E. Pop Mart is currently trading near +1SD at 24x NTM P/E. Given the declining margins, slowing growth, and a fundamentally uncompelling competitive advantage, I think Pop Mart should trade in line with peers somewhere in the 17x to 20x range.

Valuation today looks compelling for a significant derate should my thesis materialize. I assign 20x NTM P/E on base case with +24% topline growth, 19% operating margins, and +22% EPS growth. This translates into a target price of HK$14.30, -38% upside from 10-Feb-23’s closing price of $HK22.90. I see no reason for Pop Mart to trade above 22x unless management can prove to investors that topline growth and operating margin can sustain > +50% and > 23% respectively in the next 2 years. I used DCF as a sanity check and arrived at a target price of HK$11.90 (refer to appendix for full details). All in, I arrive at a net downside of 37%.

I gave a generous 26x NTM P/E on bull case with both risks playing out – +30% topline growth, 23% operating margins, and +34% EPS growth. This translates into a target price of HK$25.50, +11% upside from 10-Feb-23’s closing price of $HK22.90.

Catalysts

I identify 3 fundamental metrics that will drive stock price.

1. No. of store openings for FY23 – this largely determines Pop Mart’s expected revenue size and growth for the year

2. Gross Margin – An inevitable resurgence of Covid cases is expected to disrupt supply chain with likely 150-300 bps of margin impact

3. Operating Margin – Overseas expansion is expected to incur higher logistics costs and S&D costs, thereby contracting margins

Near term catalysts includes:

1. FY23E outlook should confirm a material slowdown on topline growth and invalidate street’s overoptimistic estimates. Upcoming review of FY22’s full year results and FY23E’s outlook of new store and Roboshop openings is likely to give street a ballpark on FY23E’s full year revenue range. A yoy growth < 50% should wake the street from current valuation and drive a derate on NTM P/E multiple to < 22x.

2. Potential listing of competitors KK Group and 52TOYS. Both KK Group and 52TOYS are pop toy companies based out of China and are direct competitors to Pop Mart. 52TOYS previously completed a RMB400mn of series C financing back in Sep-21 and teased the idea of exploring an IPO to fund growth. KK Group submitted an application on 23rd Jan to list on the HKEx, with Morgan Stanley and Credit Suisse as joint sponsors. Progress on competitors’ IPO plans could drive institutional investors to rotate out of Pop Mart to other pop toy competitors.

What if I turn out wrong

(1) Accelerated overseas expansion strategy with FY23E outlook of > 120 new stores and > 500 new Roboshops in meeting consensus estimates could potentially please investors and prevent P/E from falling under 25x.

(2) Raw material costs of paints and inks commodity prices soared by 36% in the last 3 years and is now at an all-time high price. Should prices normalize in FY23E, Pop Mart could experience an expansion on gross margins by up to 300bps for 1H23E.

Risk to Reward

Should the above risks materialize, I would see a +11% upside vs. a base case of -38% upside from 10-Feb-23’s closing price of HK$22.90. This gives an overall risk to-reward of 1 to 3.3. What are you waiting for?

On a macro angle, Pop Mart has a high beta of 1.39. Macro volatility driven by investor optimism of China reopening, improved consumer confidence, and results of economic indicators such as industrial production, manufacturing PMI, and PBoC loan prime rate, will have significant impact on share price movements. Historically, share price tend to react between 9-14% on better or worse than expected economic indicator results.

My thoughts on the toy business

The toy business operates on a few generally accepted principles. Listen to your consumers. Do not fall in love with your product. R&D is better at predicting failure than success. Product is king, only when marketing is done right. Many of the most wildly popular products are so bizarre that no rational businessperson would invest a cent in them.

Unpredictability prevails, and silliness is a valuable asset. Toy people describe their industry as a fashion business like the apparel industry; as a fad business that thrives on novelty; as an entertainment business similar to Hollywood blockbuster films. They are all right; the toy business manages to combine the problems of all three into their space.

As in the apparel business, toy follow trends and fashions. An unpleasant fact of life that toys share with apparel is seasonality, except that in the toy business it is worse. Apparel manufacturers and retailers usually have > 2 seasons to capture their sales for the year. The toy business has one. Christmas season buying has always accounted for bulk of toy sales, and it still does. ~60% of toys sold at retail are sold in Q4. Case in point, Mattel and Hasbro tend to sell most of their goods in the last quarter of the year, and often lose money during the first three quarters. Waiting for that burst of buying at the end of the year is nerve wracking. Volume is unpredictable, and so are choices. The faddish nature of toy business leaves companies extremely vulnerable to inventory risks. Like movies, toys must also possess the “entertainment” factor to succeed. A toy with no story (established via intensive marketing) is a toy with no sales.

Life span of many toys is so brief that toy companies typically have to replace a large portion of sales each year with totally new SKUs. As a rule of thumb, toy players typically sell a product line for one year. Any product line that survives longer than three years can practically be considered a classic. Duplication is one of the many reasons why toys have such short life spans. It is always easier to copy a proven idea than to create one. The low barriers to entry into the toy business drives imitation, thereby tiring the public with repetitions.

Satisfied toothpaste customers become repeat customers. But no matter how much joy you get out of a toy, consumers are not going to go out and buy another. It does not get used up. In many industries, makers of durable goods are able to count on customer satisfaction to sell other products, trading on strength of their good name. A consumer who has a good experience with apple smartphone will look favourably on other apple products. But toys, they cannot trade on brand loyalty. Consumers could not care less who manufactured or designed the toy. It is purely an arbitrary I like it or I don’t.

All in, toymakers are an enterprising breed, faced with high ratio of product failures, short product life spans, and no brand loyalty from target market. It’s a tough business to compete in.

Pop Toy

Pop toys refers to toys infused with a subtle blend of pop culture and trendy content. Product lines of pop toys range from blind boxes to action figures and adult-oriented assembled toys. Pop toys typically originate from licensed contents such as movie, animation, cartoon, and game characters, thereby serving as a good fit for purpose of display and collection. The pop toy industry’s main target audience are young and culturally proficient individuals between the ages of 15 and 40 – specifically the Millennials and Gen Z. Pop toys can be broadly categorized as either derivative or original.

i) Derivative pop toys refer to product line of established art formats where toys are manufactured off original licensed contents from film and cartoon shows. Examples include Mickey Mouse, Spongebob Squarepants, Power Rangers, etc.

ii) Original pop toys refer to product line which does not rely on established contents, and are created as originals. These characters start in the format of pop toys before being adapted into other art formats of films and cartoon shows. Examples include Lego and Barbie.

Sector Drivers

According to Frost & Sullivan, China’s pop toy retailing market is expected to grow at a 5-year compounded annual growth rate (CAGR) of 29.8% from 2019 to 2024.

I identify three industry drivers contributing to this high double-digit growth.

1. China’s Phenomenon of Guochao (国潮)

In the last decade, Guochao has become a powerful draw for increasingly nationalistic young consumers in China. Guochao refers to modern consumer goods infused with Chinese cultural elements as a key selling point. Very often these elements come from traditional Chinese culture, though they can also refer to modern pop culture, patriotism, or old-school (“time-honored”) brands and childhood nostalgia. For observers of China market, one frustrating reality of the rise of Guochao is its amorphous nature. Since Guochao can exist across product categories and is subject to ad-hoc adoption, there is no fixed market size. However, what is certain is that many brands have been incorporating Guochao elements to boost sales in recent years.

According to the “2022 China New Consumer Brand Development Trend Report”, brands active in the Guochao market have seen a growth rate three times higher than ordinary brands, with a fast-growing number of consumers seeking these brands out due to what it calls “a sense of belonging and a sense of achievement.” Along with this rising interest has come rising prices for Guochao brands or products. Guochao brands are becoming more and more expensive because domestic Chinese brands have passed the era of “cheapness,” and then passed a good cost-to-value ratio. When quality, design, and culture fully catch up with international brands, consumers will gradually accept paying the same prices for Chinese and international brands. All in, the phenomenon and effects of Guochao translates into superior growth in China across the consumer space relative to global growth rates.

2. Blockbuster Intellectual Properties (IPs)

Increasing numbers of blockbuster IPs have been released and promoted, which in turn leads to higher demand for derivative pop toys. High-quality content and IPs also create opportunities for cross-over collaborations to attract more fans. The dynamics of the China market with ~1.4bn in population serves as a land for entertainment consumption and has over the years experienced aggressive growth in audience for popular content from producers across US, Japan, and domestically.

Evidently, this explains the superior industry growth profile of China at 29.8% compared to the global pop toys retail market at 16.1%. Consequently, the % of IP-licensed toys and dolls in China has been catching up with global peers. According to Euromonitor, the % of IP-licensed toys in China expanded by 9.7% from 2008 to 2019 compared to global peers which expanded by ~6% during the same period. For the dolls & accessories segment in particular, the percentage of IP-licensed toys expanded by 16.5% from 2008 to 2019 compared to global peers which expanded by ~10% during the same period. A significant uptick of 9% in IP-licensed dolls & accessories was noticed in 2019, largely driven by the IP licensing of Pop Mart’s characters.

3. Innovative Selling Approaches

Blind boxes, also known as blind collectibles, is one of the most popular selling approaches today. While blind box is not a new format and has been used in traditional toy marketing for some time, I observe that sales approach plays a significant role in toys’ sales growth. The addictive nature of blind box purchases boils down to two elements – i) Low ASP, and ii) User Engagement – which has similar effects to lottery gambling. The low ASP serves as a low threshold for consumers to purchase a blind box with the hopes of completing their pop toy series collection just like how the low ASP of lottery ticket serves as a low threshold for adults to purchase a ticket with the hopes of striking the lottery. Failure in achieving desired outcomes of completing the series or striking the lottery ultimately spurs repurchase habits from consumers.

Frost & Sullivan estimates that blind box sales in China experienced a 143.2% CAGR over 2015-19, compared with other pop toy product sales at 29.7% CAGR over the same period. One of the key reasons that blind boxes come back with such strong force is that increasingly digitally connected markets allows for easier consumer reach with interactive purchase experience. The growth of streaming services, social media and e-commerce channels allow toys to build hype faster than ever.

Barriers to Entry & Value Chain

The toy market has relatively low barriers to entry. Unlike the tech and industrial sector where deep technical expertise is required, toy development is a fairly simple process where the creator designs the toy to his/her liking before filing IP rights to that toy design. The creator will then reach out to contract manufacturer for production and packaging. Finally, the creator sells his/her toy to consumers through online and offline sales channels.

All in, the straightforward production and distribution process with no need for deep technical expertise allows for anyone and everyone to enter the space. This ultimately explains the low barriers to entry into the toy market. The ability to grow and establish strong brand equity is hence the key in differentiating and emerging as a market leader in the toy market.

Competitive Landscape

The low production costs allow players to easily achieve gross margin north of 45%. Market leaders and players with differentiating edge (brand equity and product differentiation) can command gross margins as high as 70%. Gross margins can also differ among players depending on its distribution channel. Direct-to-consumer (DTC) channels (> 45%) generally command higher gross margin relative to players who sell primarily via wholesale channels (< 40%).

Costs only truly intensifies at the OpEx level with S&M constituting > 50% of a toy business’s cost structure. Average operating margin lies in the low mid-teens to single digit. The Lego Group (private), quite possibly the highest quality toy player in the world backed by its product abilities of instilling early childhood development, has best-in-class operating margin of > 30%. This is a stark contrast to global toy players – Mattel, Hasbro, Bandai, Sanrio etc. – with low-teens operating margins ranging from 10-15%. The nature of thin margins coming even from the largest players reflects the brutal challenges of competing in the toy business.

The pop toy retailing market in China is largely fragmented with competitors from both international and domestic brands. According to Frost & Sullivan, the top five market players contributed 23% market shares of China’s pop toy retailing market by retail value. Toy players compete for market share through brand recognition, fan base, product popularity and quality, price, effectiveness of marketing, and sales & distribution network. On a global level, Pop Mart’s competitors includes i) The Lego Group, ii) Mattel, iii) Hasbro, iv) Bandai, v) Sanrio, and vi) Funko. Pop Mart is 5-10x smaller on its bottom line with significantly shorter brand heritage (13 years) compared to its global peers (min. of 40 years). Within China, Pop Mart’s direct competitors includes i) 52TOYS, ii) KK Group, iii) IP Station, iv) Rock Bear, and v) Finding Unicorn.

Company Overview

Pop Mart design and sell pop toys primarily in China through multiple offline and online sales channels. As of 30 June 2022, Pop Mart’s offline sales channel includes 308 retail stores, 1,916 Roboshops, wholesales and conventions largely across China. Its online sales channel includes Tmall, JD.com, Pop Draw, and others. Retail store forms the bulk of Pop Mart’s total revenue at 39%, followed by Pop Draw at 23%. Roboshop, Tmall, and wholesales forms 9% respectively. The remaining channels constitute < 3% of total revenue respectively.

Product Line

Pop Mart has 4 categories of product line – i) Blind Box, ii) Action Figures, iii) Ball-Jointed Dolls (BJDs), and iv) Accessories.

Blind Box prices ranges from RMB49 to RMB99 per pop toy with a packaging that keeps the collectible toy as a mystery until it is opened, exactly like how trading cards are sold. Each series has a unique theme and generally contains 12 different designs, including a specially designed “hidden edition”. Blind Box constitutes > 75% of Pop Mart’s total revenue.

Action Figures prices ranges from RMB199 to RMB1499 per figure. Compared to blind boxes, action figures are larger in size and more expensive. They are designed in more delicate and artistic styles, manufactured with more sophisticated materials, and usually exposed to high-end consumers.

BJDs prices ranges from RMB399 to RMB799 per doll. These dolls are articulated with ball and socket joints, featuring movable bodies. Most BJDs are made with easily removable clothing, wigs, eyes and limbs, allowing customisation for collectors.

Accessories include a variety of products ranging from hang tags to pins and fluffy pendants.

Competitive Advantage (or the lack thereof…)

Pop Mart’s competitive advantage is its brand equity. Although Pop Mart was founded in 2010, its brand equity only started growing in 2014 when the company transited from a lifestyle brand selling multiple types of products (similar concept to LOG-ON and Miniso) into pop toy stores exclusively selling toys. As Pop Mart’s brand equity grew, it established reputation among artists and formed a platform to attract top artists in creating blockbuster IPs such as “Molly”, “Pucky”, and “Dimoo”.

Artists typically possess strong expertise in creative work but lack resources and experience in design commercialization. Pop Mart’s ability to handle manufacturing, logistics, marketing, and network distribution effectively addresses the bottleneck of artists’ design commercialization. The value proposition of revenue-sharing for artists’ design commercialization, backed by Pop Mart’s presence across China, is what attracts artists to collaborate with Pop Mart. This win-win model of IP creation for Pop Mart and revenue-sharing for artists ultimately ignited a network effect for Pop Mart to sustainably attract top artists for more blockbuster IP creations.

The street’s bull thesis on Pop Mart is simply a story of the firm being the largest pop toy player in China, poised to gain market share from being an early mover in a fast growing pop retail space backed by competitive advantage of its strong branding and IP development capabilities. However, this top-down industry growth thesis can be challenged and flipped with ease.

Here’s why… Fundamentally, Pop Mart’s competitive advantage is uncompelling. Pop toys purchase is predominantly driven by consumers’ taste and preference rather than needs. The difficulties of quantifying consumers’ tastes subjects Pop Mart’s business to fads with hit or miss R&D outcomes. Importantly, the low barrier to entry allows for competitors to easily replicate Pop Mart’s IP creation strategies. Case in point, there are many established pop toy companies in China with IP creation strategies similar to Pop Mart – 52Toys, Block 12, KK Group, IP station, Rock Bear, and Finding Unicorn. Most of these competitors also have licensed IP partnerships with Walt Disney, Universal Studios etc. The harsh reality here is that pop toys in China has essentially been commodified. There is no way for one firm to truly differentiate itself from another.

That said, credit is still given where credit is due. Pop Mart deserves respect for its ability to achieve > 20% operating margins simply from selling zero functional value plastic-made goods. The company also has a healthy track record of high-teens ROIC, positive free cash flow (FCF), and a debt-free balance sheet. Unlike many hot IPOs in recent years, Pop Mart has also distinctively proven profitability through its innovative selling approach (low ASP of blind box easily triggering repeat purchase) and its prudent store expansion strategy (none of their stores are loss-making). These are high-quality characteristics that even global players such as Hasbro, Mattel, and Bandai struggle to achieve.

Revenue Drivers

Pop Mart’s main product – blind box – has an ASP of RMB70. Pop Mart’s lack of competitive advantage and inferior functional value products translates into zero pricing power. I view pricing as a constrained lever to pull in raising Pop Mart’s ASP. Case in point, if Pop Mart really had pricing power, then their margins would not have contracted by > 1000 BPS in the last 4 years.

Pop Mart currently has 308 retail stores and 1,916 Roboshops across China. I expect Pop Mart to further expand into Taiwan, Hong Kong, Japan, South Korea, Singapore, and into tier 3 and 4 cities domestically. I estimate Pop Mart to open 70-120 new retail stores and 200-300 Roboshops per year from FY23-25E. I view volume through new retail store and Roboshops openings as the sole lever for Pop Mart to pull in driving organic topline growth.

Cost Drivers

Plastic at ~5% of sales as raw material for moulding, die-casting, injection, and trimming of the toy figurine. Pop Mart uses ABS (Acrylonitrile Butadiene Styrene) and PVC (Polyvinyl Chloride) plastic for their toys.

Paint and ink at ~12% of sales as raw material for spraying and hand painting of the toy figurine. Rising commodity prices of raw materials used in producing paint and coatings such as pigments (titanium oxide and zinc oxide) and solvents (mineral turpentine) has meaningfully contracted Pop Mart’s gross margin in the last 3 years from 67% in CY2H19 to 58% in CY1H22. I estimate 3-4% of the margin contraction coming from the elevated and ongoing surge in paint prices.

Toy blister packaging, aluminium foil bag, PE film (Polyethylene Film), desiccant, paper card and cardboard boxes at ~4% of sales. These are raw materials for assembly and packaging of the toy into its final packaged form.

Manufacturing costs at ~8% of sales to contract manufacturers for the manufacturing process. Ongoing blue-collar labour shortage in China, especially in the manufacturing sector, continues to be a factor compressing Pop mart’s gross margin. As China’s labour shortage is an ongoing structural issue, I expect manufacturing costs to stay elevated at ~8% of sales for the next 2 years.

Design fees and license fees both at ~1.5% of sales respectively. Selling and distribution (S&D) expenses at ~28- 30% of sales. General and administrative (G&A) expenses at ~12- 14% of sales. I see a huge possibility of S&D and G&A as a % of sales emerging at the upper range or even expanding by a few hundred BPS due to higher costs of expanding overseas.