Business Overview

Wolfspeed (WOLF) is a wide bandgap semiconductor player that sells

i) Silicon Carbide (SiC) and Gallium Nitride (GaN) materials,

ii) Power devices, and

iii) Radio-frequency (RF) devices

Key end-market of these devices lies primarily in electric vehicle (EV) powertrains, EV charging, 5G, renewable energy and storage, and aerospace and defense.

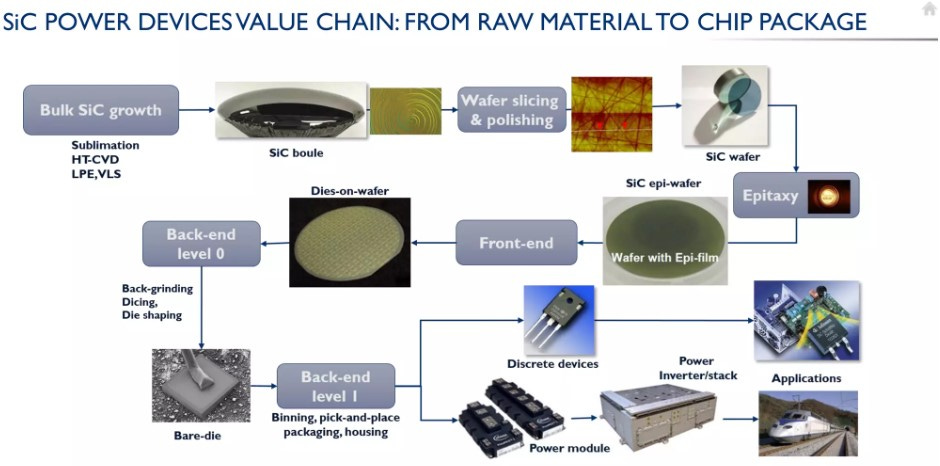

WOLF is a pure-play vertically integrated SiC player where they grow their own SiC crystals in producing SiC wafers, fabrication of wafers into bare die, and depending on application, packaging into packaged devices (SiC MOSFETs, Schottky Diodes and GaN devices).

From Cree to WOLF

WOLF was formerly known as Cree, Inc. (Cree), a light emitting diode (LED) player focusing on LED and lighting products with applications in indoor and outdoor lighting, video displays, transportation, electronic signs and signals, power supplies, and wireless systems.

Cree operated in three reportable segments

i) Lighting Products

ii) LED Products

iii) Wolfspeed (SiC, GaN, Power devices, RF devices)

The lighting products segment primarily consists of LED lighting systems and lamps where Cree design, manufacture and sell lighting fixtures and lamps for commercial, industrial, and consumer markets.

The LED products segment on the other end consists of LED chips and components in enabling their customers to develop LED-based products for lighting, video screens, automotive, and other industrial applications.

Prior to 2018, Lighting and LED products formed bulk of revenue (> 90%) while WOLF’s contribution was insignificant (~10% of total revenue, <US$250mn).

In Oct-2017, Cree underwent a strategic review process in identifying the best opportunities to drive shareholder value creation. The company identified WOLF as the largest opportunity for shareholder growth and shareholder value creation. Despite the minute revenue size, WOLF at that time was (and as of 30-May-23 still is) the industry leader in SiC technology due to the IP portfolio, scale advantage, experience in the business (manufactured over 100mn of SiC devices), and the manufacturing scale that they possessed over its peers.

This announcement came after a series of actions. Cree first spun out its SiC and RF business as Wolfspeed in 2017. The company tried to sell Wolfspeed to Infineon for US$850mn in 2016 but was blocked by the Committee on Foreign Investment in the US. Cree then took a 180° switch from attempting to offload its power semiconductor business to transitioning into a power semiconductor pureplay.

The management thesis by Cree in 2017 was the transition of powertrain in automobiles from traditional internal combustion engine (ICE) to EVs and rollout of EV charging stations would significantly increase their serviceable addressable market (SAM) in SiC. Cree saw a large multi-decade growth opportunity with SiC in EV, Solar energy, Telecommunications, Industrial, and Mil/Aero. The end-market tailwinds meant high double-digit compounded annual growth rate (CAGR) on topline over the next decade with plenty of room for margin expansion. The thesis effectively served as a catalyst for Cree’s transformation from a LED player into a powerhouse semiconductor player. And so, Cree made the transition in turning WOLF into their primary growth engine.

Fast forward to 1-Mar-21, Cree sold their LED business SMART Global Holdings, Inc. and its wholly owned subsidiary CreeLED, Inc. On 4-Oct-21, Cree renamed themselves as Wolfspeed and transferred the listing of their common stock from Nasdaq to NYSE.

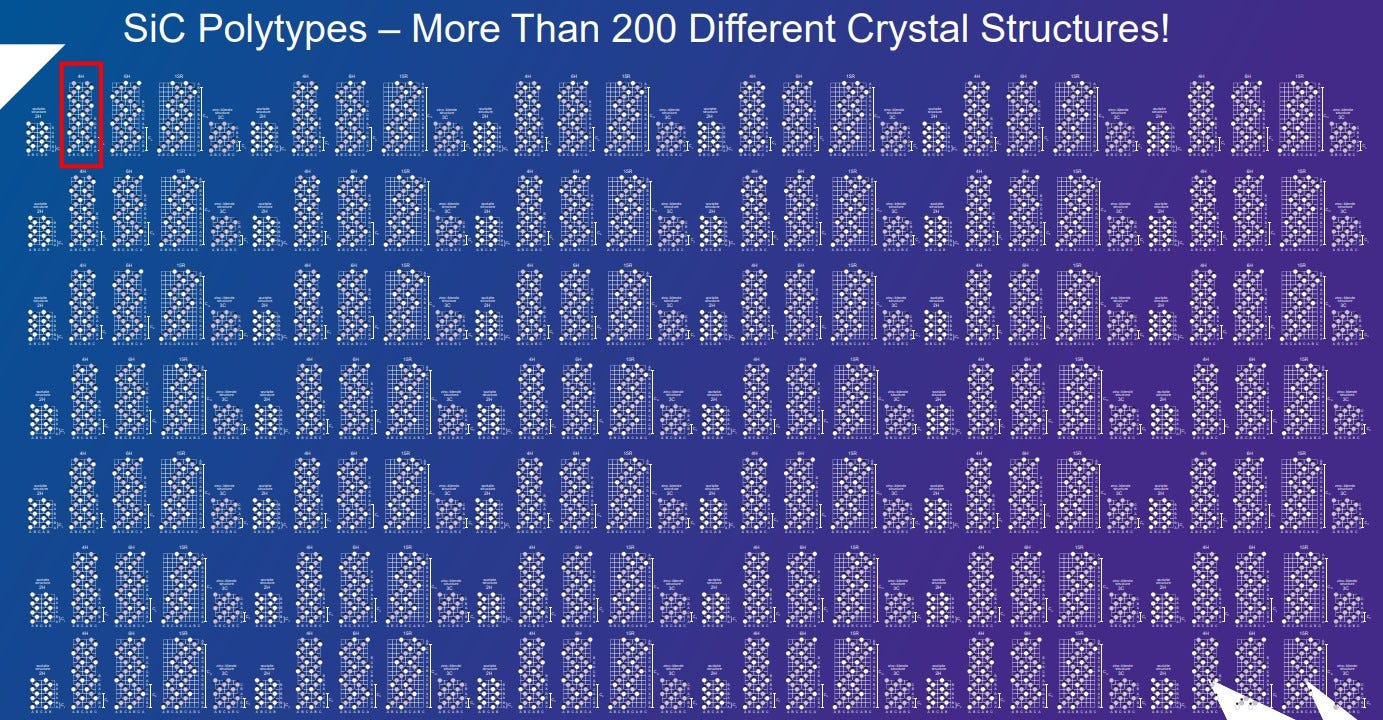

Silicon Carbide 101

SiC, also known as carborundum, is a combination of silicon and carbide that exists in meteorites in the form of moissanite but almost nowhere else naturally. Most SiC commercially available today are hence synthetically made. There are approximately 250 different crystalline variants of SiC where each have their own unique physical traits. Of the 250, only 3 can be used for electron devices, 3C, 4H, and 6H. 3C wafers are not commercially available due to instability at high temperatures. While research has been done on 6H-variant, the 4H SiC structure is the industry standard today.

SiC has an average density of 3g/cm3, which makes it relatively light in weight. It is chemically inert and corrosion-resistant, and is not attacked by any acids, molten salts, or alkalis even when exposed to temperatures up to 800°C. SiC is an extremely hard and strong material (which makes sense considering its application as an abrasive material).

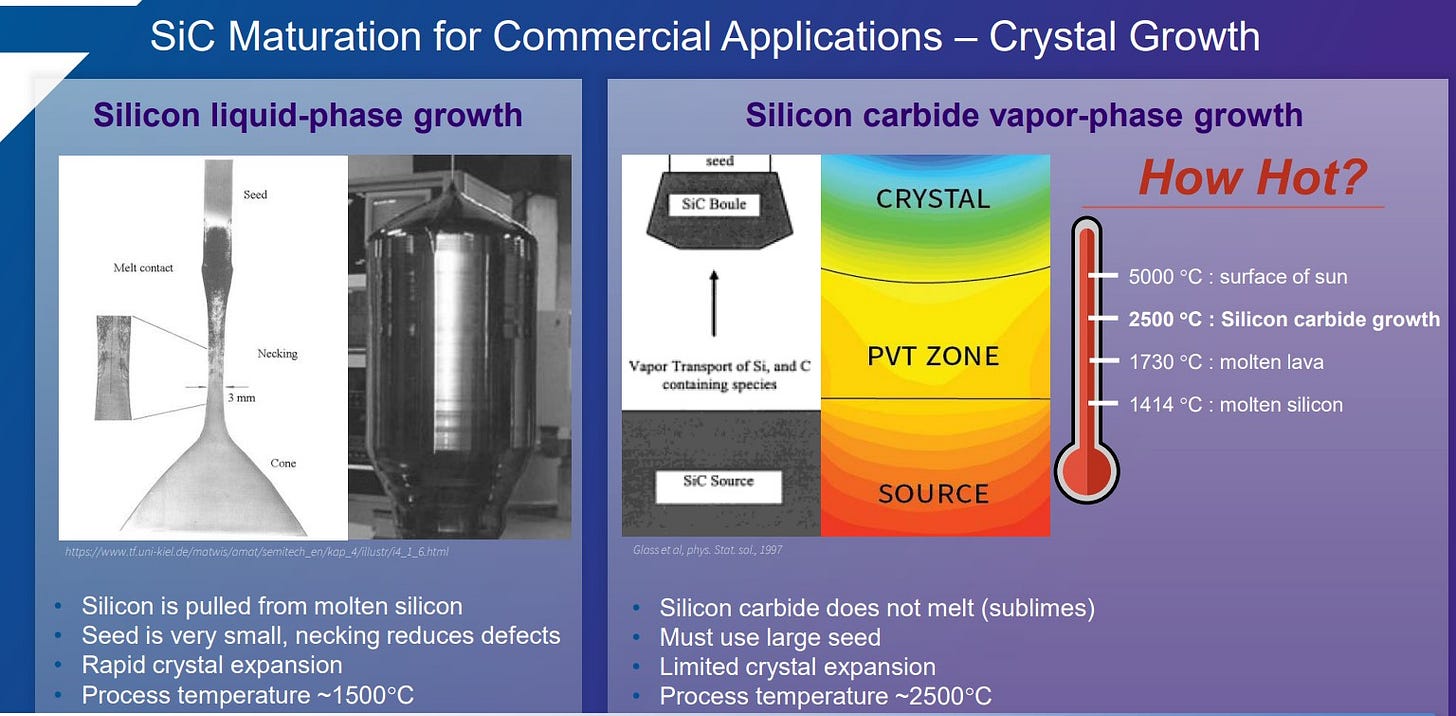

SiC has a very low coefficient of thermal expansion, which means that even when exposed to extreme temperature changes, it remains dimensionally stable (e.g., it will not significantly expand when exposed to heat or significantly contract when exposed to cold). It also has excellent thermal shock resistance. Importantly, SiC is capable of sublimation – when temperature is high enough (2700°C around half the surface temperature of the sun), SiC skips the liquid form and goes directly to a gaseous form. This means that it turns into a vapor instead of melting.

The inherent properties of SiC described above present significant challenges to its production and requires a different manufacturing process from traditional Si Wafers. Due to its hardness (almost diamond-like), SiC requires higher temperature, more energy, and more time for crystal growth and processing. Main defects that can occur during the manufacturing of SiC substrates are crystalline stacking faults, micropipes, pits, scratches, stains, and surface particles. These factors, potentially adversely affects the performance of SiC devices. In addition, the 4H SiC crystalline structure is characterized by high transparency and high refractive index, making it difficult to inspect the material for surface defects that could potentially affect epitaxial growth or final component yield. This effectively redefines the manufacturing process of SiC wafers in contrast to traditional Si Wafers. Keep this in mind as this leads to WOLF's competitive advantage and positioning in the SiC space which I'll take about in the later segment.

SiC as a Semiconductor

SiC as a semiconductor has 3 key properties – i) high critical breakdown strength, ii) wide bandgap, and iii) high thermal conductivity – which better serve as a substrate for heavy duty power applications.

i) High critical breakdown strength allows for reduced package insulation while retaining the same voltage rating, ability to withstand higher voltage without changing the package size, and creating components with blocking voltages that are an entire order of magnitude higher than what is possible with Si.

ii) Bandgap refers to the energy difference between the top of the valence band and the bottom of the conduction band. A more intuitive way of understanding bandgap is the amount of energy needed for an electron to successfully make the jump between the valence band and the conduction band. Because semiconductors can both conduct and insulate, they will always have a non-zero bandgap that lies somewhere between what you would see with an insulator and a conductor. The bandgap of SiC is 3.26, compared to that of Si at 1.12. Because SiC has a much wider bandgap than other semiconductor materials such as Si or GaAs, it possesses some critical advantages, including the ability to handle higher voltages and power, higher operating temperatures, faster switching, better efficiency, and a significantly smaller form factor.

iii) The higher the thermal conductivity, the easier it is for the semiconductor to dissipate any heat that is generated. This, in turn, allows the components made from semiconductors with good thermal conductivity to be smaller, and in some cases eradicates the need for thermal cooling systems.

SiC adoption today has reached an inflection point driven by increased commercialization of SiC technology, EV adoption the primary driver

A few factors contributed to this inflection point…

First, we are seeing an increasing number of large-scale, triple-digit € mn design wins being awarded by car OEMs, suggesting a more broad-based EV adoption of SiC beyond the early movers such as Tesla. Infineon has made significant progress of late having been a late starter in the early stages of the technology’s rollout, likely in part due to its focus on trench-based technology, and now has five triple-digit USD mn auto SiC design wins.

Second, multiple large semis producers have increased SiC revenue targets. STMicro brought forward its US$1 bn revenue target from 2025 to 2024 and thereafter to 2023 (as compared with >US$700 mn in 2022), while WOLF has also commented on upward pressure to its FY26 SiC revenue target since its 2021 analyst day. WOLF’s quarterly design-ins have also recently accelerated, to US$1.6 bn in the past two quarters (vs an average of US$700 mn since 1Q21).

Third, most conversations that SiC device makers have with large OEMs are now centred on the ability to secure enough SiC production capacity, rather than evaluating and explaining the benefits of the technology per se (suggesting that SiC has matured in recent years, with the mass production of several high-end EVs using SiC technology a key proof point, e.g. Tesla already occurring). In particular, recent WOLF commentary suggests that supply chain issues for key components in ICE vehicles may contribute to a faster transition to SiC in certain instances, given SiC capacity expansions.

Today, the rate of SiC substrate adoption, manufacturing sophistication, and available supply in the market today is 30 years behind Si. Still, the use of SiC-based devices promises a significant increase in system efficiency and far higher switching frequencies than what today’s Si-based devices can offer.

SiC’s efficacy in EV applications and other power electronics is largely credited to the material itself. Compared to silicon, SiC offers:

10X higher dielectric breakdown field strength

2X higher electron saturation velocity

3X higher energy bandgap

3X higher thermal conductivity

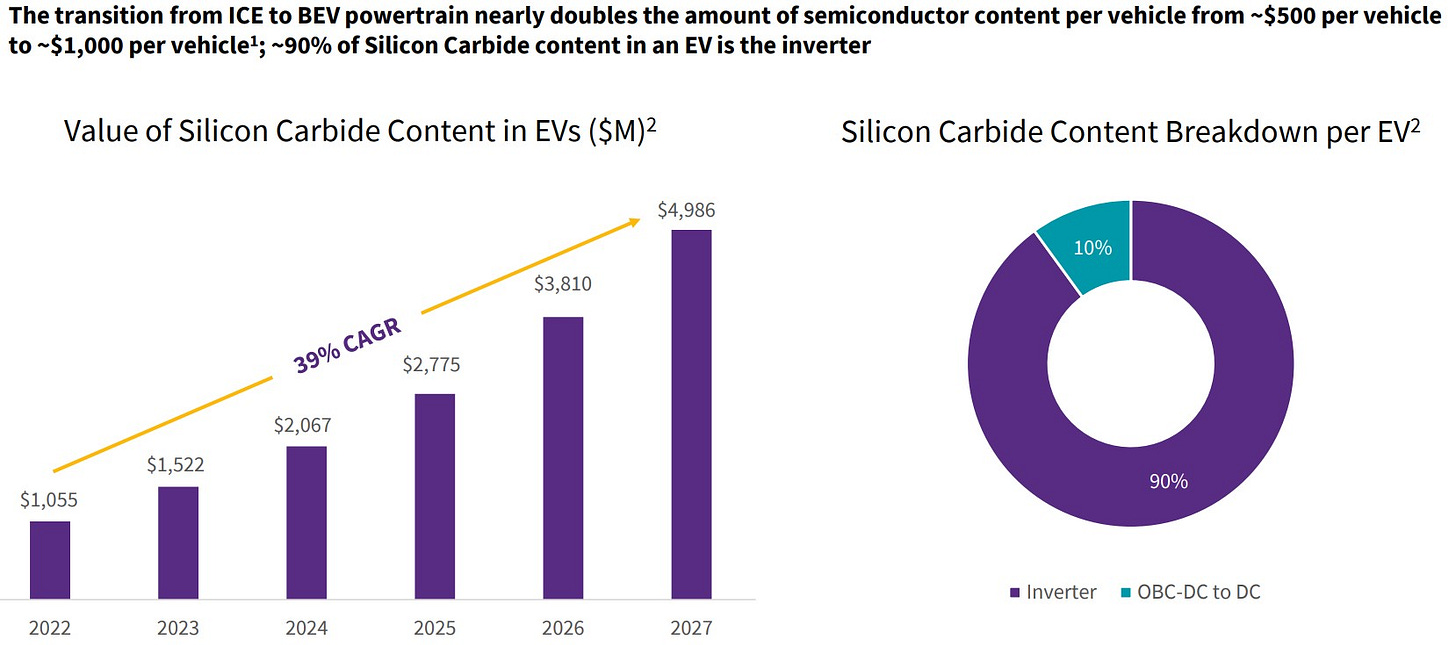

Bridging the superior properties of SiC to EVs, using SiC-based devices allows for higher driving range on a single charge, smaller battery sizes for traction inverters, and faster charging time for on-board chargers (OBCs). One of the biggest opportunities for automotive content lies in its gasoline engine replacement — the powertrain’s traction inverter. When direct current (dc) flows into an inverter, the converted alternating current (ac) helps run the car’s motor to provide power to the wheels and other electronic components. Replacing existing silicon switching technologies with advanced SiC chips reduce the amount of energy loss in the inverter, enabling the car to deliver extra range by 5-10%.

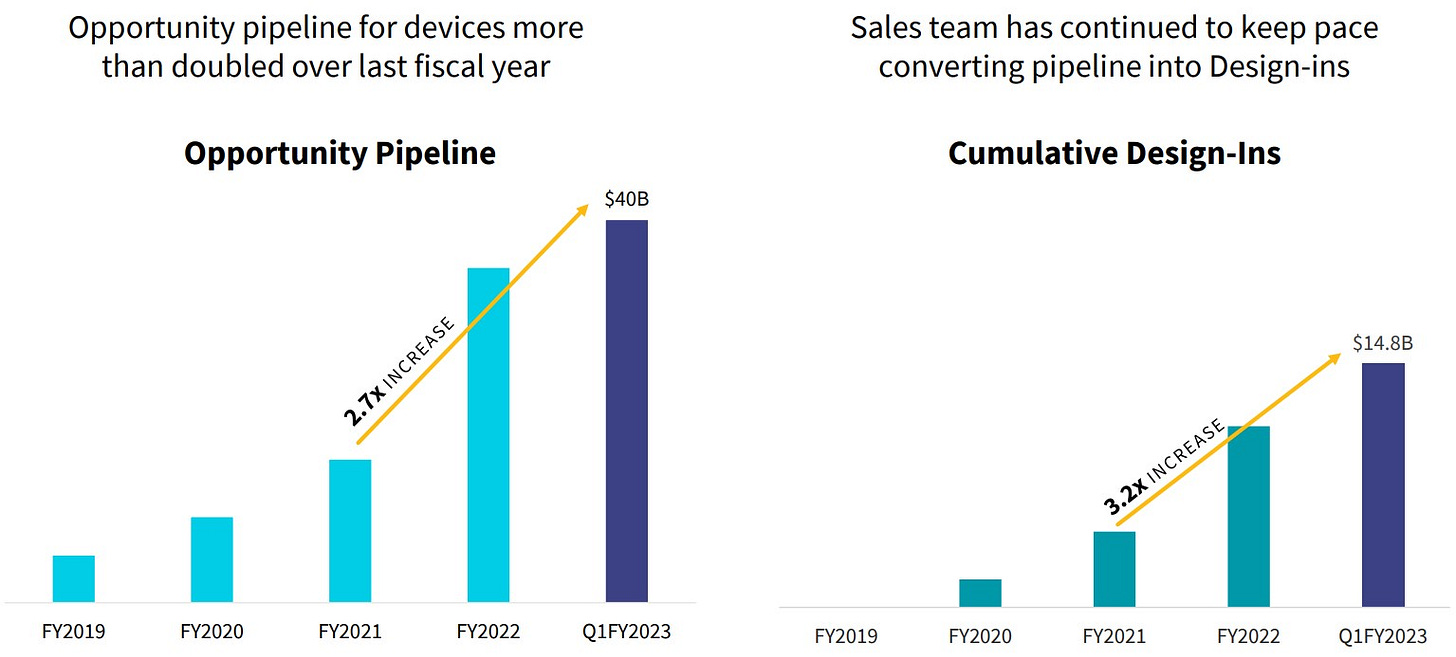

Opportunity Pipeline, Design-Ins & Design Wins

Based on the US$40bn opportunity pipeline today, WOLF converted ~US$15bn into design-ins, and of which, a 43% conversion rate into design wins. Meaning to say ~US$15bn worth of customers have engaged WOLF for qualification of SiC products, be it for substrate or power devices. Of which, 43% (US$6.45bn) has been secured as future revenue. The strength in WOLF’s design-ins and conversion to design wins is instrumental in providing revenue visibility in the next 5-years, though this would also be largely dependent on the progress of building 10 in Durham today.

WOLF’s definition of design-ins: customer commitments to purchase our product and are one of the factors we use to forecast long-term demand and future revenue. To meet the qualification of a design-in, the customer provides us with documentation (e.g., a letter of intent, statement of work or developmental contract) that can include details such as the expected delivery timeline, estimated price, necessary capacity and required support. A design-in, even with a formal commitment, does not always convert to future revenue for a variety of reasons, including, but not limited to, the customer delaying or abandoning the project, capacity constraints, timeline challenges, and/or technology changes. Therefore management uses the design-in amount as a guide to forecast future demand but it should not be taken as an absolute indicator of future revenue.

A key driver of WOLF’s SiC opportunity pipeline today stems from EV demand driving acceleration of SiC adoption. The transition from ICE to BEV powertrain is expected to quintuple the value of SiC content per EV – according to Yole Power SiC 2022 report, SiC content per EV is expected to grow at 39% CAGR from $1055 in FY22 to $4986 in FY27. Apart from EVs, the applications and benefits of SiC is now spreading into the broader transportation industry such as public transports, avionics, airplanes. Outside of automotive, non-transportation applications in the industrials, power supply, and energy space are also picking up the pace of SiC adoption.

WOLF’s Competitive Advantage

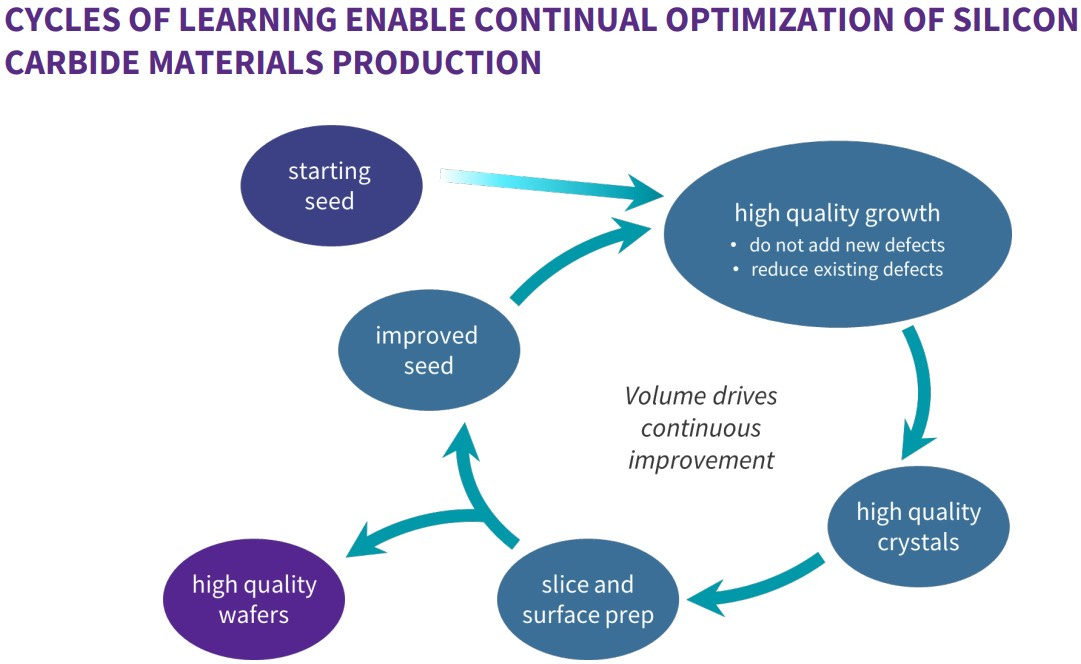

In my opinion, WOLF’s core competitive advantage is its scale. According to Yole, WOLF currently has 62% market share in SiC wafer supply, 4x bigger than the 2nd largest player Coherent. WOLF’s positioning today stems from its early entrance into the SiC space. They were the first company to commercialize SiC wafers back in 1991. Lack of commercialization opportunities in SiC coupled with high barriers to entry due to challenges in manufacturing 4H structure SiC substrate meant a small and unattractive TAM with limited competition. Consequently, WOLF ate up majority of the pie in the last 3 decades and hence its dominant position in the SiC wafer supply space today.

Distilling it down a step further, I would allude WOLF’s true edge to be its seed quality. To appreciate the importance of seed quality, we first have to understand how Si and SiC are made.

Si wafer production first begin with the growth of a Si ingot. Growing a silicon ingot can take anywhere from one week to one month, depending on many factors, including size, quality, and the specification. To grow an ingot, the first step is to heat the Si to 1420°C in a crucible. Once the polycrystalline and dopant combination has been liquefied, a single Si crystal 3mm in size, the seed, is positioned on top of the melt, barely touching the surface. The seed has the same crystal orientation required in the finished ingot. This seed will then be inserted into the crucible and slowly withdrawn until a large crystal is formed. Upon completion, a large, solid Si boule weighing several hundred pounds is produced. The boule is then tested to ensure its purity before being sliced into thin wafers.

SiC on the other hand, due to its physical properties of extremely high melting point and sublimes rather than melt, requires furnaces that can process temperature beyond 2500°C and wafer slicing machines that can slice through SiC boules that are twice as hard as traditional Si boules. Importantly, the seed will have to be large and pure in quality in growing the 4H SiC structure boule.

Taking into consideration WOLF has been doing this for the last 35 years, I would take comfort in thinking the quality of their seeds and pace of wafer production today are levels beyond what competitors can do today. This is also backed by key SiC players such as ST Micro, Infineon, and On Semiconductor engaging with WOLF in long-term agreements for SiC wafers. This ultimately positioned WOLF in front of the cost curve while competitors play catch up. That said, I do expect competitors to continue coming up with alternative technology in the power semi space such as Infineon’s cold split technology and SOITEC’s smart stacking that would erode WOLF’s edge.

Manufacturing Facilities

Given that WOLF and the SiC space is supply constrained over the next decade, major SiC players (Infineon, ST Micro, ON Semi, Rohm) today are intensively allocating capex in expanding manufacturing capacity. The winners of tomorrow will hence by highly dependent on the pace of capacity expansion today.

WOLF currently has 3 manufacturing facilities, 2 in Durham, North Carolina, 1 in Marcy, New York – i) RTP Factory, ii) Durham Factory, and iii) Mohawk Valley Fab (MVF).

RTP Factory is a small subscale stock-type factory at 1495m2 where it serves as a wafer fab for manufacturing MFT and Schottky power devices (150mm) and RF devices (100mm)

Durham Factory on the other hand, still a subscale factory but slightly bigger at 4950m2, serves as both a wafer fab (Durham Fab) and a SiC Materials production facility. Materials capacity in Durham is expected to increase by 50% via construction of Durham Building 10 in the coming quarters.

WOLF recently completed construction of MVF and is now undergoing qualifications and ramping up. This is the first and only 200mm SiC wafer fab in the world. Once the fab reaches a certain level of utilization, the Durham Fab will shift to MVF. Effectively, Durham will be for SiC materials production while MVF will be for fabrication of wafers produced in Durham. MVF is a game changer for WOLF as automation and wafer size advantages is expected to lower die cost by more than 50%. As of FY3Q23, WOLF’s gross margin stands at 29.8%. Margin can only expand meaningfully when MVF reaches 20% utilization (planned for end CY24). Importantly, Durham Fab has reached full capacity. All future top line growth in power devices will come directly from MVF.

Going forward, WOLF will be constructing a new manufacturing facility in Siler City known as The John Palmour Manufacturing Centre (The JP) for SiC materials production. The JP will provide 10x the capacity of what Durham is producing today and will be the key driver in taking MVF beyond 20% utilization.

Execution Problems A Recurring Theme

WOLF is currently facing challenges of scaling their materials business in Durham to feed MVF due to

i) infrastructure delays in construction of Durham Building 10, and

ii) management taking a “more methodical approach to growing substrate capacity”.

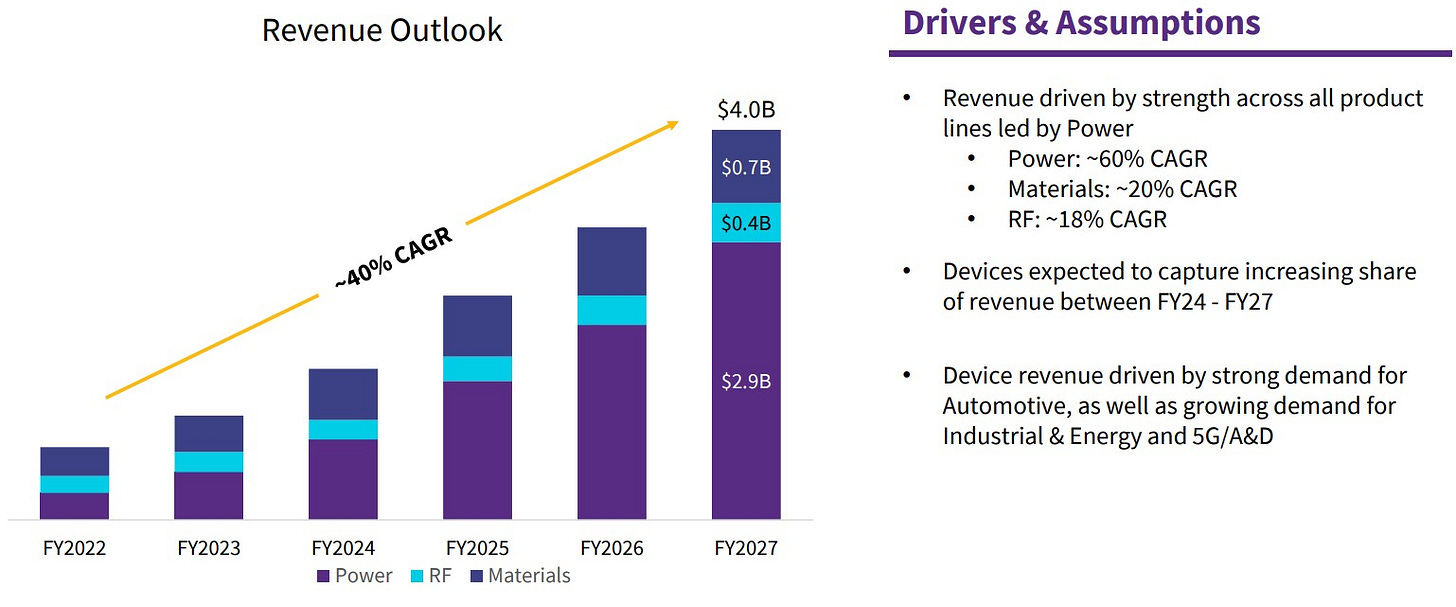

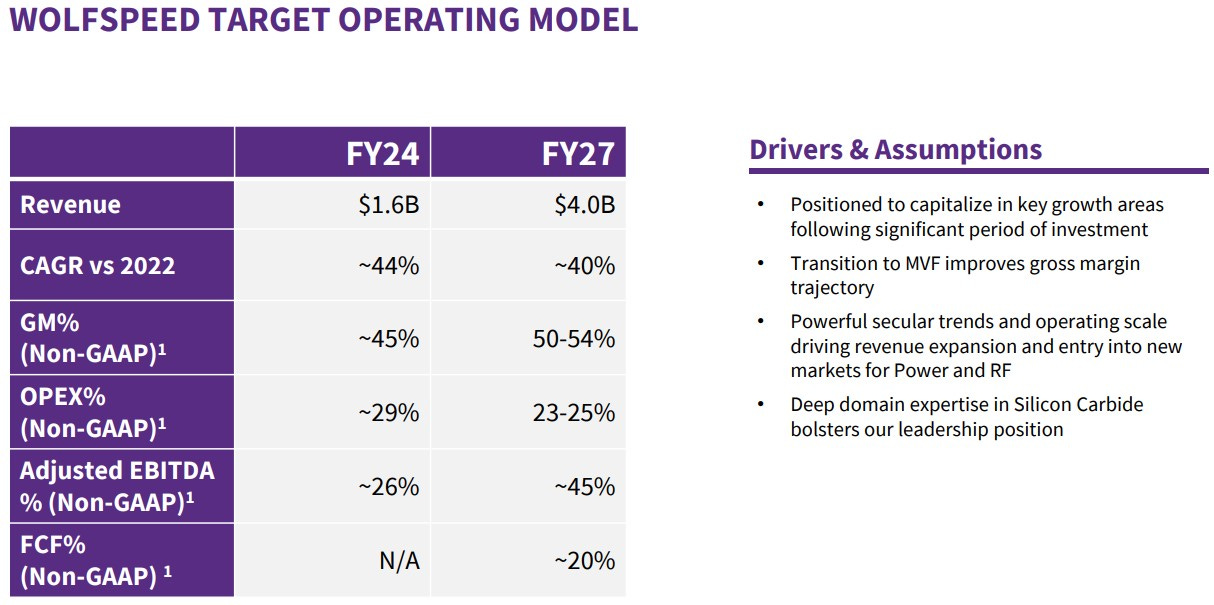

The infrastructure delays relate to supply chain issues with electrical infrastructure and switchgears where lead times was longer than what WOLF had previously anticipated. Point (ii), simply put, can be viewed as management toning/guiding down on their overly optimistic FY27 targets (US$4bn revenue, ~52% gross margin, ~45% EBITDA margin, ~20% FCF) in cognizance of weak execution and unforeseen delays in capacity expansion in the next few years.

On a high level, the impact here is a 3-6 months delay on WOLF’s long-term financial targets. Consequently, margins are expected to remain flat at ~28-30% (Non-GAAP GM) for the next few quarters.

Execution problem appears to be a recurring theme for WOLF. In the last 2 years, WOLF faced issues in its Durham fab where its 150-millimeter MOSFET yields fell below expectations for a couple of quarters due to taller boules. And now another execution problem of delays in ramping up MVF’s utilization. Consequently, we are seeing a significant guide down for FY24 based on the initial guidance laid out in 2022’s analyst day. Gross margin expected to remain in the high 20s for the next 2-3 quarters, a long way to go before we can see a meaningful progress to the 50-54 range. FY24 revenue target has also been guided down from US$1.6bn to US$1-1.1bn. It is important that management resolves these issues, as this seems like more than a transitory problem. FY24 guidance, for the first full year of MVF, was the guidepost for much of the last 3 years, so to fall this far short is a major blow to investor confidence. At this point, WOLF’s SiC secular growth story has turned into a show-me story. Execution problems being a recurring issue reflects poorly on management track record and raised eyebrows on ability to meet its long-term targets. Incrementally, delays to these targets also implies loss of market share to Infineon, ST Micro, On Semi, and Rohm.

Don’t get me wrong, WOLF’s long-term story is valid, and I personally like it. Eventually they will get to the 40% CAGR on topline growth and 54%/45% gross/EBITDA margin target. But given that everyone is on the ramp up, timing is hence key. Any delays to these targets would imply loss of market share to competitors – specifically Infineon, ST Micro, On Semi, and Rohm.

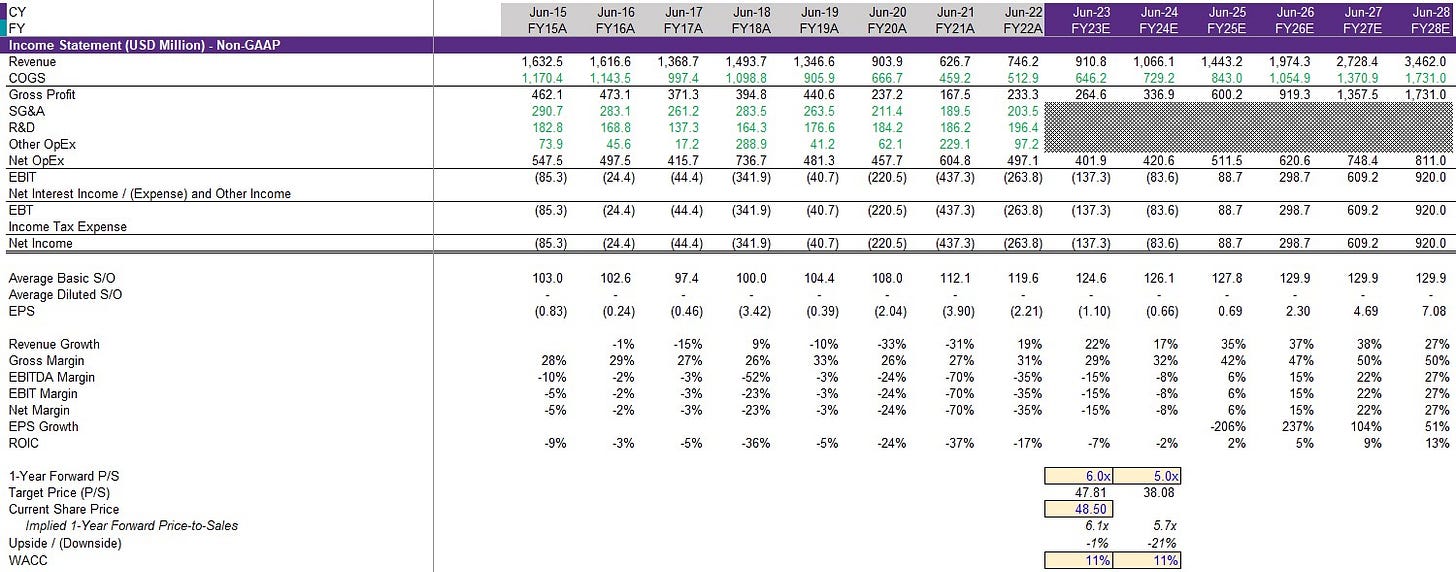

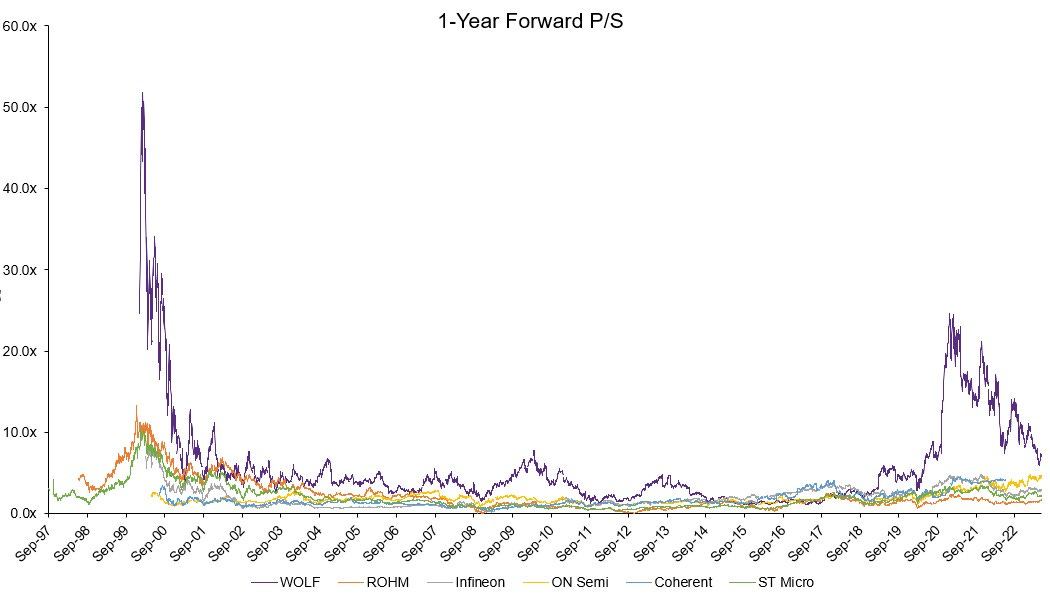

WOLF’s Financials & Valuation

Stock price today ($49.06 as of 3-June-23) implies 6x P/S. Given the recent 200mm delays and a significant guide down for FY24, topline is expected to remain muted while margins continue to remain underwhelming in the high 20s to low 30s. Taking into consideration the last 2-3 years of poor execution, and the potential delays and pushbacks in the coming quarters, I would only assign WOLF 5x P/S. This brings me to a target price of ~$38, 22% downside from current levels, not the best way to play the SiC story today in my opinion. A better way would be AEHR, check it out here =)

test